All Categories

Featured

Table of Contents

That normally makes them a more affordable option forever insurance policy coverage. Some term plans may not keep the premium and death profit the same over time. You don't wish to wrongly think you're acquiring level term protection and afterwards have your death advantage modification later on. Lots of people obtain life insurance policy coverage to assist financially shield their loved ones in case of their unexpected death.

Or you might have the alternative to transform your existing term insurance coverage into a long-term plan that lasts the rest of your life. Different life insurance policy plans have possible advantages and disadvantages, so it is essential to recognize each prior to you determine to buy a policy. There are several advantages of term life insurance, making it a popular option for coverage.

As long as you pay the costs, your beneficiaries will receive the death advantage if you die while covered. That claimed, it is essential to keep in mind that most policies are contestable for 2 years which indicates coverage could be rescinded on death, should a misstatement be located in the app. Plans that are not contestable commonly have actually a rated fatality advantage.

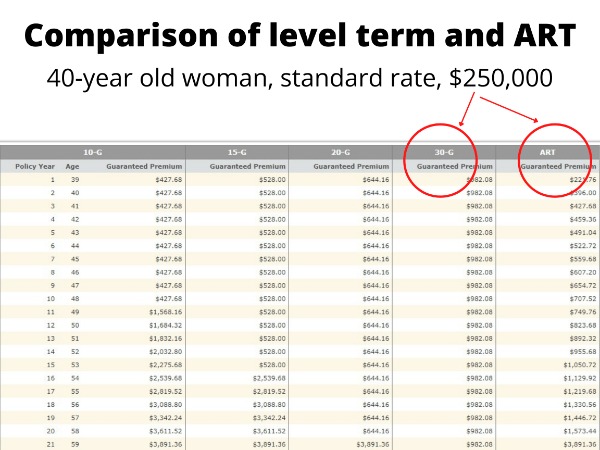

Premiums are usually reduced than entire life policies. With a degree term policy, you can pick your insurance coverage amount and the policy size. You're not locked into a contract for the rest of your life. Throughout your policy, you never have to bother with the costs or survivor benefit amounts changing.

And you can't squander your plan during its term, so you won't obtain any type of monetary gain from your previous protection. As with other kinds of life insurance policy, the expense of a degree term plan depends on your age, insurance coverage demands, work, lifestyle and health. Normally, you'll locate more budget friendly insurance coverage if you're more youthful, healthier and much less risky to guarantee.

Tax-Free The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

Since degree term costs stay the same for the period of insurance coverage, you'll understand exactly just how much you'll pay each time. That can be a large assistance when budgeting your expenses. Level term coverage also has some adaptability, permitting you to personalize your policy with additional features. These often come in the form of riders.

You may have to satisfy details conditions and qualifications for your insurance provider to pass this motorcyclist. There additionally can be an age or time limitation on the coverage.

The fatality benefit is normally smaller, and protection typically lasts until your youngster transforms 18 or 25. This cyclist may be a more cost-effective method to aid guarantee your children are covered as cyclists can commonly cover numerous dependents at the same time. Once your child ages out of this insurance coverage, it might be possible to convert the rider right into a new policy.

The most common type of long-term life insurance policy is whole life insurance policy, however it has some essential distinctions compared to degree term insurance coverage. Right here's a basic introduction of what to take into consideration when contrasting term vs.

Term Vs Universal Life Insurance

Whole life entire lasts insurance policy life, while term coverage lasts insurance coverage a specific periodParticular The costs for term life insurance coverage are commonly reduced than whole life insurance coverage.

Among the major functions of level term coverage is that your costs and your fatality benefit don't alter. With lowering term life insurance coverage, your costs remain the very same; nonetheless, the death benefit amount gets smaller in time. You might have insurance coverage that begins with a fatality advantage of $10,000, which can cover a home loan, and then each year, the fatality benefit will lower by a set amount or percent.

Due to this, it's usually a more economical sort of level term protection. You might have life insurance via your employer, yet it may not be adequate life insurance policy for your demands. The initial step when getting a policy is establishing exactly how much life insurance policy you need. Consider elements such as: Age Household size and ages Employment status Earnings Financial debt Way of life Expected final expenditures A life insurance coverage calculator can aid determine just how much you need to start.

After choosing on a policy, finish the application. For the underwriting procedure, you may have to provide basic individual, health and wellness, lifestyle and employment info. Your insurance provider will establish if you are insurable and the threat you might offer to them, which is mirrored in your premium expenses. If you're approved, authorize the paperwork and pay your first costs.

Budget-Friendly Short Term Life Insurance

Lastly, take into consideration organizing time each year to examine your plan. You may intend to upgrade your recipient info if you've had any type of substantial life modifications, such as a marriage, birth or separation. Life insurance coverage can in some cases really feel difficult. You don't have to go it alone. As you discover your choices, take into consideration reviewing your needs, wants and interests in a monetary expert.

No, degree term life insurance coverage doesn't have cash worth. Some life insurance policy policies have an investment function that allows you to build cash worth in time. A portion of your costs payments is set aside and can earn interest in time, which grows tax-deferred throughout the life of your insurance coverage.

You have some alternatives if you still desire some life insurance policy coverage. You can: If you're 65 and your coverage has run out, for example, you might desire to acquire a new 10-year degree term life insurance policy.

Outstanding Decreasing Term Life Insurance

You might have the ability to transform your term insurance coverage into an entire life policy that will certainly last for the rest of your life. Lots of sorts of level term policies are exchangeable. That indicates, at the end of your insurance coverage, you can convert some or all of your policy to whole life coverage.

Level term life insurance is a policy that lasts a set term normally between 10 and three decades and features a level fatality advantage and degree premiums that stay the same for the entire time the plan is in impact. This implies you'll recognize specifically just how much your settlements are and when you'll have to make them, permitting you to spending plan accordingly.

Level term can be a great option if you're looking to purchase life insurance policy coverage for the very first time. According to LIMRA's 2023 Insurance coverage Measure Research Study, 30% of all adults in the United state need life insurance policy and do not have any kind of type of plan. Degree term life is predictable and budget-friendly, which makes it one of the most prominent sorts of life insurance policy.

Latest Posts

Funeral Cover Plans

Final Expenses Insurance Quotes

Burial Expense Insurance Companies