All Categories

Featured

Table of Contents

Policies can additionally last up until defined ages, which in the majority of cases are 65. Beyond this surface-level information, having a higher understanding of what these strategies involve will assist guarantee you purchase a policy that meets your needs.

Be mindful that the term you select will affect the costs you pay for the policy. A 10-year degree term life insurance policy policy will set you back much less than a 30-year policy because there's less possibility of an event while the strategy is active. Lower danger for the insurer relates to decrease premiums for the insurance policy holder.

Your household's age ought to also influence your policy term choice. If you have little ones, a longer term makes good sense since it safeguards them for a longer time. If your children are near their adult years and will be financially independent in the near future, a much shorter term could be a better fit for you than an extensive one.

When contrasting whole life insurance coverage vs. term life insurance coverage, it deserves noting that the latter typically sets you back much less than the former. The outcome is much more protection with lower costs, providing the very best of both globes if you need a substantial quantity of insurance coverage but can not afford an extra costly policy.

How Does Level Term Life Insurance Definition Compare to Other Policies?

A degree death benefit for a term policy typically pays out as a swelling sum. Some level term life insurance coverage companies permit fixed-period settlements.

Passion repayments received from life insurance coverage policies are taken into consideration earnings and are subject to taxes. When your level term life plan runs out, a few various points can take place.

The downside is that your sustainable degree term life insurance policy will certainly feature greater costs after its initial expiry. Advertisements by Cash. We might be made up if you click this ad. Advertisement For novices, life insurance policy can be made complex and you'll have inquiries you want answered prior to devoting to any type of plan.

Life insurance firms have a formula for determining risk using death and passion (What is level term life insurance). Insurers have countless clients securing term life plans at once and make use of the costs from its energetic plans to pay surviving beneficiaries of various other policies. These business make use of mortality to estimate how lots of people within a specific group will certainly file fatality insurance claims per year, which information is made use of to establish typical life spans for possible policyholders

In addition, insurance provider can spend the money they get from premiums and increase their earnings. Because a level term plan doesn't have cash money value, as an insurance policy holder, you can't spend these funds and they do not provide retirement earnings for you as they can with entire life insurance policy policies. Nevertheless, the insurer can invest the cash and earn returns.

The list below section information the advantages and disadvantages of degree term life insurance policy. Predictable costs and life insurance policy protection Simplified plan structure Potential for conversion to irreversible life insurance Restricted protection duration No cash money worth build-up Life insurance coverage premiums can boost after the term You'll locate clear benefits when comparing degree term life insurance to other insurance policy types.

What is the Function of What Is A Level Term Life Insurance Policy?

From the moment you take out a plan, your premiums will never change, assisting you prepare economically. Your coverage will not differ either, making these plans efficient for estate planning.

If you go this route, your costs will enhance however it's constantly good to have some flexibility if you wish to keep an energetic life insurance coverage plan. Renewable degree term life insurance coverage is another alternative worth thinking about. These plans permit you to keep your present plan after expiration, offering adaptability in the future.

What Are the Terms in Guaranteed Level Term Life Insurance?

You'll select a protection term with the ideal degree term life insurance rates, yet you'll no longer have coverage once the plan runs out. This downside could leave you scrambling to discover a brand-new life insurance plan in your later years, or paying a costs to extend your existing one.

Lots of whole, global and variable life insurance policy policies have a money value component. With among those policies, the insurer deposits a part of your monthly premium repayments into a cash worth account. This account makes passion or is invested, aiding it expand and give a much more substantial payment for your beneficiaries.

With a level term life insurance coverage policy, this is not the situation as there is no cash value element. Therefore, your plan will not expand, and your survivor benefit will certainly never ever boost, therefore limiting the payout your recipients will certainly receive. If you want a policy that provides a survivor benefit and develops cash money worth, check out whole, global or variable strategies.

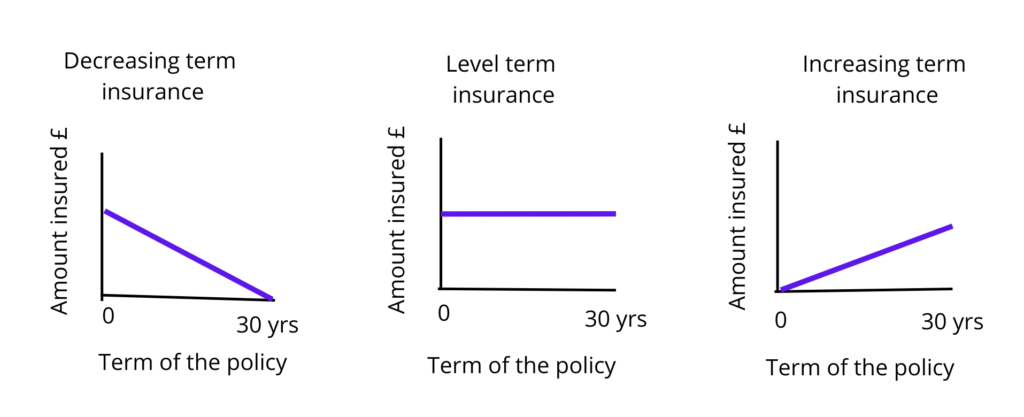

The second your policy expires, you'll no much longer have life insurance policy coverage. Degree term and decreasing life insurance deal similar plans, with the primary distinction being the death advantage.

It's a sort of cover you have for a certain quantity of time, known as term life insurance coverage. If you were to pass away while you're covered for (the term), your loved ones receive a set payment concurred when you take out the plan. You simply pick the term and the cover quantity which you could base, for instance, on the expense of raising children till they leave home and you might utilize the payment towards: Assisting to settle your home loan, financial debts, bank card or financings Helping to pay for your funeral expenses Helping to pay university fees or wedding celebration expenses for your children Helping to pay living prices, replacing your revenue.

What Exactly Does Level Benefit Term Life Insurance Offer?

The plan has no money worth so if your repayments quit, so does your cover. If you take out a level term life insurance coverage policy you might: Pick a fixed amount of 250,000 over a 25-year term.

Latest Posts

Funeral Cover Plans

Final Expenses Insurance Quotes

Burial Expense Insurance Companies